UK National Security Regime: Annual Report 2023 and Observations on Recent Practice

July 13, 2023

On 11 July 2023, the UK Government published its second Annual Report on the National Security and Investment Act 2021 (the “Act”).

The Annual Report begins with an introduction by Oliver Dowden MP, the Deputy Prime Minister, who is the formal decision-maker under the Act in his role as the Secretary of State in the Cabinet Office. This introduction seeks to reassure investors that the Act is a “light-touch, proportionate regime that offers companies and investors the certainty they need to do business, while crucially protecting the UK’s national security in an increasingly volatile world.”

This introduction is followed by 40 pages of statistics on how the regime has been applied over the period from 1 April 2022 to 31 March 2023. The highlights are as follows:

- 866 notifications were received by the Government: 671 mandatory, 180 voluntary and 15 retrospective (i.e., after closing). This is fewer than the c. 1,000-1,800 filings per year that the Government estimated when the draft legislation for the regime was proposed.

- Notifications have been processed quickly, with the Investment Security Unit (“ISU”) taking less than five working days on average to accept filings as complete and start the initial 30-working-day screening period. 43 of the 866 notifications were rejected, most of which because the wrong form was used (mandatory vs voluntary).

- Around 7% of notified transactions were called in for full review after the initial screening period. Decisions in the initial screening period were taken on average within 27-28 working days.

- Of the 65 transactions called in for full review, 37 were mandatory notifications, 17 were voluntary notifications, one transaction was called in having been retrospectively notified, and 10 transactions were called in without having been notified.

- Around 20% of transactions that reached a final decision after full review were subject to remedies (10) or prohibition (5), taking around four months on average from call-in to the final order.

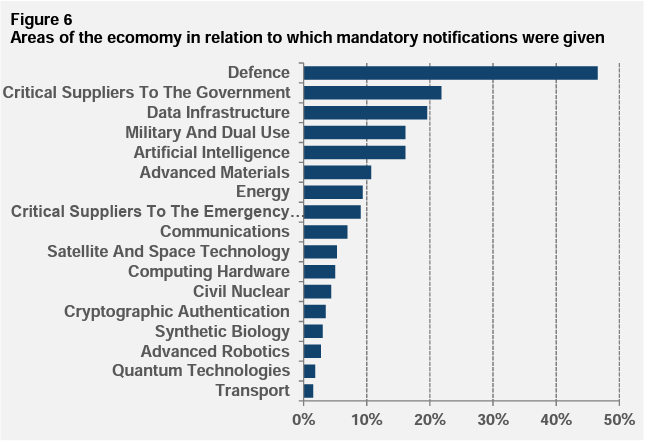

- Around 60% of notifications concerned investment from the UK, with the United States next highest at around 25%. The “defence” sector accounted for the highest proportion of notifications (c. 45% of mandatory filings and c. 15% of voluntary filings).

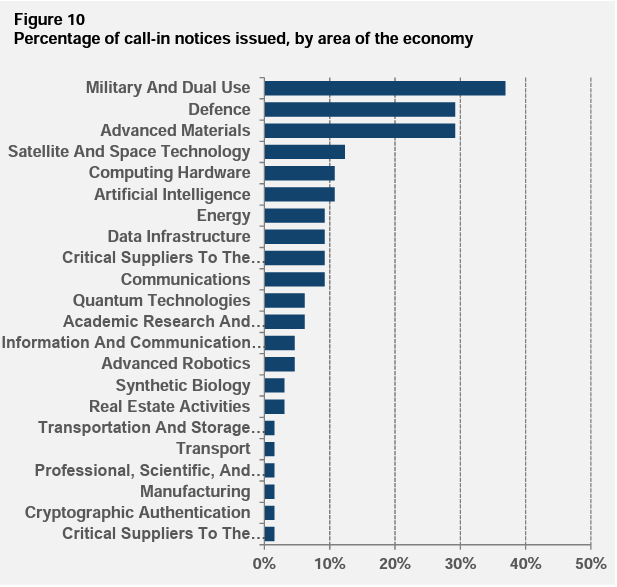

- Around 40% of transactions called in for review related to Chinese investment, 30% concerned investment from the UK, and 20% related to investment from the United States. The most frequently concerned sectors were “military and dual use” (42%), advanced materials (32%), and defence (26%).

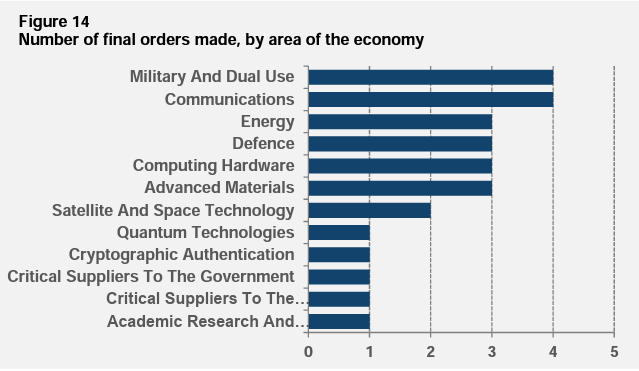

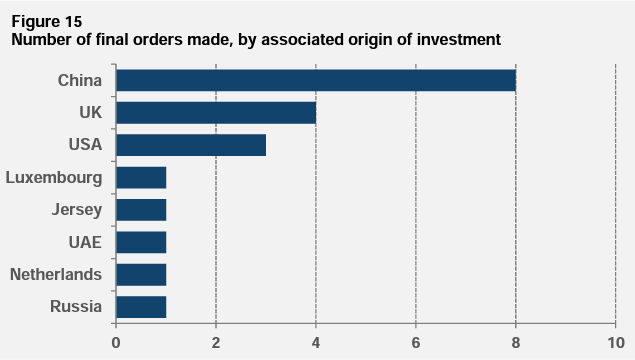

- Of the 15 final orders (remedies or prohibition), eight related to investment from China, four concerned UK investment, and three related to investment from the United States. The “military and dual use” and “communications” sectors accounted for the most final orders (four each).

- All five prohibitions related to investment from China (four) or Russia (one): Beijing Vision Technology Company Ltd’s acquisition of Manchester University IP, Super Orange HK Holding’s acquisition of Pulsic Limited, Nexperia’s acquisition of Newport Wafer Fab, and SiLight (Shanghai) Semiconductor Limited’s acquisition of HiLight Research, and L1T FM Holdings UK’s acquisition of Upp Corporation.

- 11 notifications were withdrawn. It is unclear whether these were withdrawn because national security concerns were identified and the acquirer decided to abandon the transaction rather than risk publication of an adverse final decision (which updated guidance in April 2023 made clear was possible) or because the transaction did not proceed for commercial reasons.

- There were no penalties or criminal prosecutions for breaching the Act, including for completing a notifiable transaction without approval (though there were 15 retrospective notifications, a process for notification of transactions that should have been notified before closing but were not).

Observations on practice to date

Beyond the raw statistics set out in the Annual Report, we have observed the following trends over the last 18 months of the new regime.

First, the process has largely been smooth for acquisitions by investors from “friendly” jurisdictions of assets that are not highly sensitive. Filings can be prepared quickly (with less information required than merger control filings) and, as borne out in the statistics, the ISU has accepted filings quickly and issued clearances within the 30-working-day screening period.

Secondly, the prohibitions and remedies to date have been consistent with recent trends in the approach to national security issues by FDI agencies (at least in western Europe and North America). As noted above, all five prohibitions relate to transactions involving Chinese or Russian investors, and most remedies have also been imposed on Chinese investments (e.g., in energy sector assets).

Remedies imposed on “friendly” investors have concerned sensitive targets (e.g., suppliers to the Ministry of Defence) and have focused on behavioural remedies that include requirements relating to:

- Government approval for certain decisions made by the acquired entity;

- Restrictions on the sharing of sensitive information by the acquired entity with the buyer;

- The appointment of certain personnel in the acquired entity, such as board members or key staff members

- The appointment of Board observers by the UK Government;

- Continued provision of services to the UK Government; and

- R&D capabilities remaining in the UK.

Thirdly, the principal concerns with the regime are around transparency and predictability. After submitting the filing, there is frequently no interaction with the ISU before the “call in” decision is made. Even after “call in”, any insight into the ISU’s thinking is typically derived only from RFIs. This lack of engagement is exacerbated by the reluctance of other Government departments to discuss transactions while formal NSIA review is underway.

The first clear indication of any concerns is the extension of the review period by 45 working days. This signals that remedies are being considered and is typically followed by the issuing of draft remedies and first insight into the substantive basis for any concerns. In at least one case, final remedies were imposed without any prior engagement with the acquirer.

As indicated in the introduction to the Annual Report, the Government has been seeking to reassure investors that concerns regarding transparency and engagement will be addressed, though it maintains that there are limits to what possible in relation to matters of national security.

The Annual Report follows on from the publication of the Government’s updated guidance in April 2023 on the notification and review process. Please see here our alert memorandum regarding this guidance. Charts extracted from the Annual Report illustrating the statistics above follow.

Charts extracted from the Annual Report illustrating the statistics above follow.