Diversity Considerations

January 16, 2019

Gender diversity has been at the forefront of social and governance issues for corporate boards in recent years. Focus on this topic continued to intensify in 2018 and is likely to be a significant issue in the 2019 proxy season and beyond. Stakeholders of all types – from large institutional investors to employees to some state governments – have been expressing views on gender issues such as board gender diversity as well as pay equity and the #MeToo movement, with the result that many companies feel pressure to act and react to these matters on expedited timelines – sometimes with significant top-down enterprise changes. The following is a review of the most significant of these developments.

Institutional Investors

Some of the largest institutional shareholders, including BlackRock, State Street Global Advisors, Vanguard and others, have continued to emphasize the importance of board diversity. With some perceived lack of responsiveness, particularly at small- and mid-cap companies, these investors have now begun to express that view with votes, generally through votes against the chair or entire nominating and governance committee. Institutional investors have been vocal that these voting trends will continue as they become increasingly intolerant of companies that continue to fail to make sufficient progress.

Pension Funds

The New York City Comptroller Scott Stringer’s Boardroom Accountability Project 2.0 (buoyed by its success with proxy access, known as version 1.0 of the Project) sent letters to the boards of 151 companies in 2018, calling on them to disclose the skills, race, and gender of board members and to discuss their process for adding and replacing board members. In addition to board gender diversity, the NYC Comptroller has also been focused on gender pay equity at companies.

Other pension funds are also focused on these issues and have begun to reflect that view in their voting. In particular, CalPERS publicized that it voted against 438 directors at 141 companies based on a failure to respond to CalPERS efforts to encourage increased diversity. Those efforts included two large-scale letter writing campaigns that resulted in 504 companies adding at least one diverse director to the board.

Other Shareholders

Other, smaller shareholders, have also been focused on one or more aspects of diversity. For example, Arjuna Capital, a sustainable investor, has focused on gender pay equity proposals and has engaged with companies, principally in technology and banking, to release information about gender pay equity. After the 2018 proxy season, during which a number of companies voluntarily released information, Arjuna Capital released its first Gender Pay Scorecard analyzing equal pay issues at companies that had provided disclosure.

Proxy Advisory Firms

In 2019, Glass Lewis will begin recommending voting against nominating committee chairs of Russell 3000 companies without female directors (and may extend this to other nominating committee members in certain circumstances) unless the company has disclosed a significant rationale or a plan to address the lack of female directors. ISS stated it will similarly begin recommending voting against the nominating committee chairs in the Russell 3000 or S&P 1500 starting in February 2020. ISS noted a few mitigating factors it will consider, but emphasized that a lack of gender diversity should be temporary and limited to “exceptional circumstances.”

State Governments

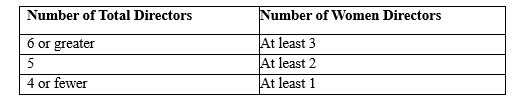

On September 30, 2018, Governor Jerry Brown of California signed into law a novel bill that made California the first state to require publicly held corporations headquartered in the state to have at least one female director by the end of 2019, or face modest financial penalties. Thereafter, California-headquartered companies will be required to have additional women directors by December 31, 2021, as follows:

California’s new law is the culmination of a push that began in 2013, when it became the first state to pass a non-binding resolution to encourage corporations to increase female representation on boards. Illinois, Massachusetts, Colorado and Pennsylvania followed suit and passed similar non-binding resolutions, and a bill similar to California’s new law is currently being debated in New Jersey.

Employees

With increased social and traditional media attention, employees are also increasingly vocal about gender issues that affect them and their employers. Companies have faced demands from employees to provide explanations for opposition statements to diversity-related shareholder proposals and pressure regarding failure to make pro-employee changes.

As companies prepare for the upcoming proxy season and related engagement with shareholders and others, we offer the following concepts for the board to consider in developing a strategy:

- No company is immune from the push for increased board diversity. A company without any diverse board members (e.g., many small- and mid-cap companies) can expect increasing pressure from investors and others. However, a board with some diverse board representation is likely to experience some pressure to continue to increase the number of diverse board members. Studies have often identified at least three directors as a “critical mass” threshold for seeing the benefits of diversity in the boardroom.

- This is not a one-time fix. Refreshment plans should not aim only to increase diversity in the short term but focus on diversity as a long term and lasting goal.

- A lack of diversity in the industry will not be an acceptable excuse for a lack of board diversity. In the past, certain industries have seemed to be insulated from the issue; that is unlikely to be the case going forward.

- Carefully consider company statements and actions from a variety of perspectives. What may be acceptable to the investor community may be problematic for employees, customers, suppliers, or other stakeholders.

- Be proactive. Expectations in this area continue to evolve, and a company that thinks broadly about these issues and implements changes proactively is more likely to avoid embarrassing and costly missteps.

- Consider diversity from a holistic perspective. Simply achieving diversity on the board will not suffice. Emerging as a likely area of future focus is the composition of key board committees and leadership roles. Diversity within senior management is also expected to be a likely area of upcoming attention. And while gender is a particular focus at the moment, other aspects of diversity are likely to become the next priorities.